GLBA non-compliance fines can reach as high as $100,000 per violation. Learn how to protect both your customers and your budget with full GLBA compliance. Let’s get started!

What Is the GLBA?

The Gramm-Leach-Bliley Act (GLBA, for short) is a US federal law that requires financial institutions to explain their information-sharing practices to customers and safeguard sensitive data.

If you’re reading this, chances are your business counts as a financial institution under the GLBA, so let’s get you straight to compliance as fast as possible, starting with Step 1.

(Or check out A Beginner’s Guide to GLBA Compliance for a more in-depth breakdown.)

Step 1: Identify & Protect

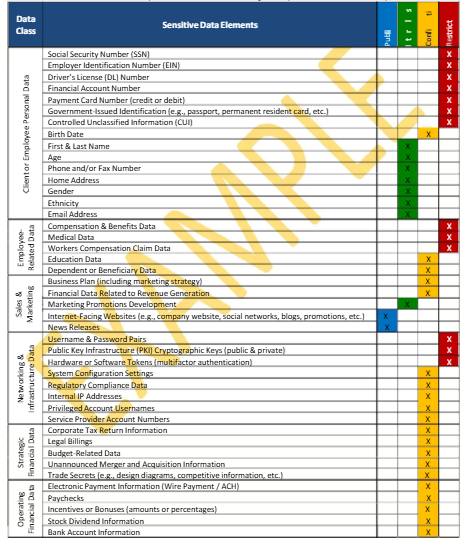

The GLBA requires mandatory data protection and compliance. But it’s hard to protect what you can’t find. That’s why the first step to GLBA compliance calls for PII discovery.

Most financial institutions store terabytes of customer data, making it challenging to locate and protect the specific PII covered by GLBA. That is, unless you deploy effective sensitive data discovery software.

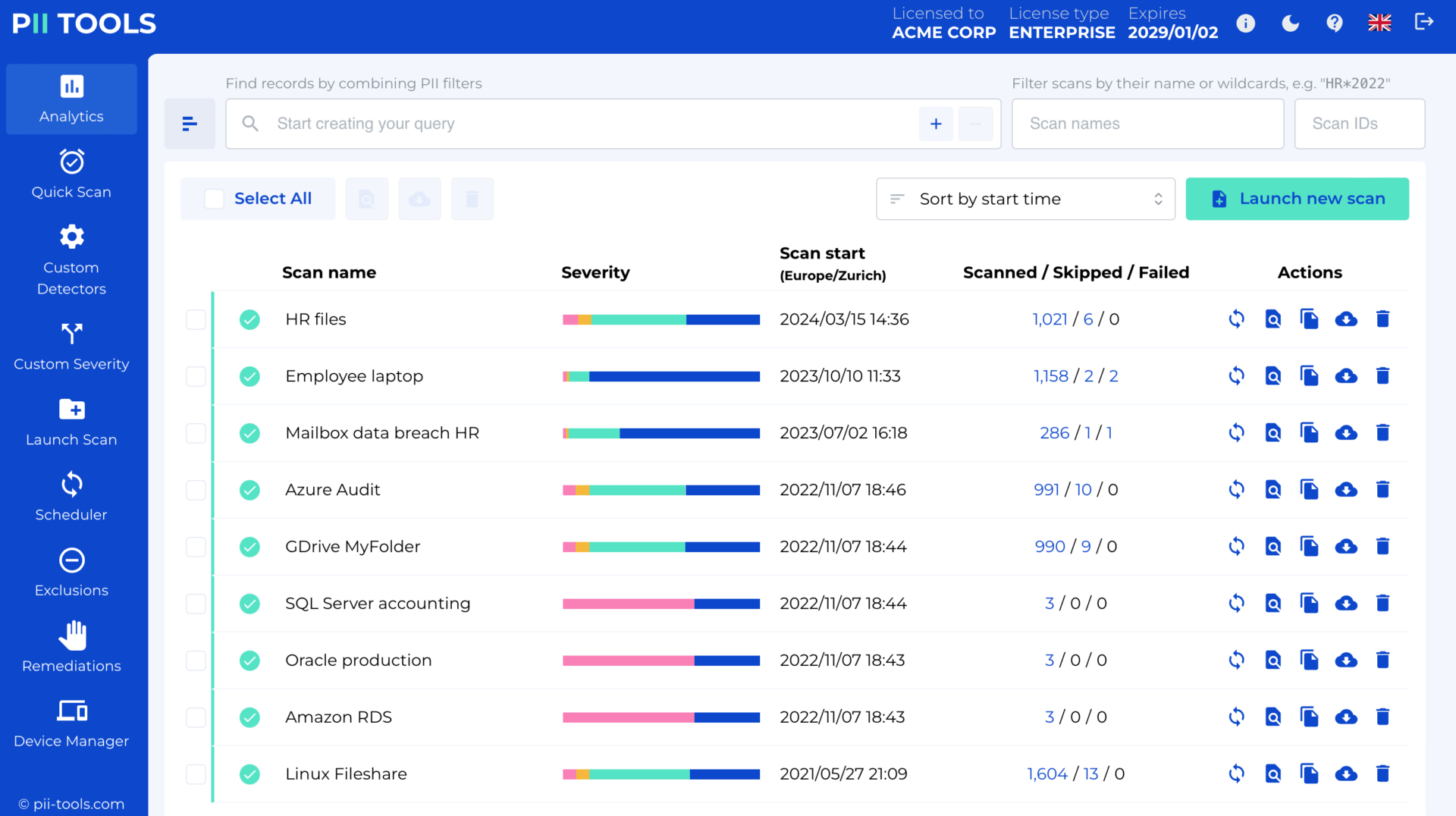

Take PII Tools, for example. Whether on-prem or in the Cloud, this in-house auditing software runs automated, AI-driven scans to discover at-risk data concerning the GLBA and others. It then provides users with helpful discovery reports and varied remediation options.

And this is where the ‘Protect’ aspect comes into play. By remediating at-risk data correctly (moving it to a more secure storage, deleting it altogether, updating authorization, etc.), you’re dramatically improving its protection level.

Step 2: WISP

WISP stands for “Written Information Security Program”. The GLBA’s Safeguard Rule mandates that every financial institution create and maintain a WISP. Think of it as your company’s “playbook”, showing how you protect customer information.

Your WISP should include:

- Appointing a Qualified Individual (DPO, security lead)

- Risk assessment explaining threats to customer data

- Implementing security controls

- Policies for monitoring, testing, and responding to incidents

- Annual reviews and updates

Source: NIST Cybersecurity Framework

Step 3: Awareness & Training

The most well-known GLBA requirement can be found in its Financial Privacy Rule, built on transparency and staff awareness. This rule mandates that all financial institutions explain to their customers what PII they collect and how it’s managed and protected.

This is done by sending out notices. These notices must include:

- Your company’s privacy policies and practices,

- Both affiliated and nonaffiliated third parties,

- An opt-out option, allowing customers to deny having their PII disclosed to nonaffiliated third parties.

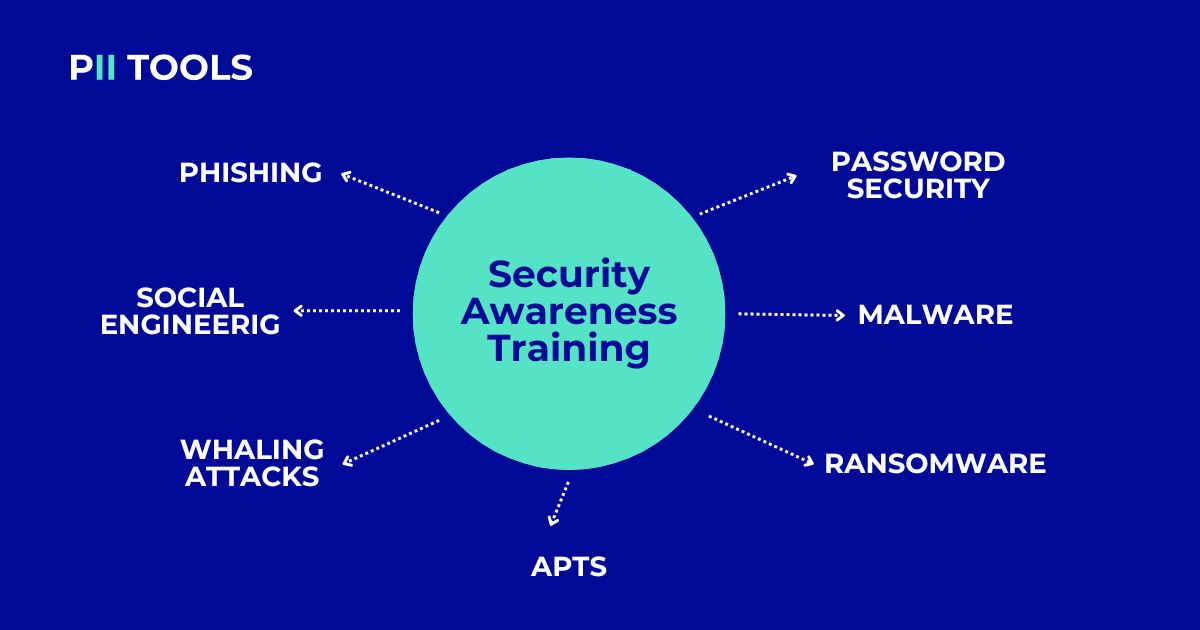

Another effective practice for GLBA compliance is ongoing employee training. Estimates show nearly 90% of all data leaks are caused by employees, making them the frontline to maintaining a proper GLBA framework.

Luckily, we’ve already created The Perfect Employee Training Guide, including all the steps and materials you need to put on an impactful meeting on recognizing PII, common data leak threats, password security, and more.

GLBA Compliance

The GLBA may be a long and complicated government mandate, but if you follow these three basic steps, GLBA compliance will be your result.

And to streamline the process even further, use PII Tools to locate all and any GLBA-related data, receive legible reports for analysis, and deploy immediate remediation options. Protect your business and those you serve, and remember, GLBA compliance is only 3 steps away!

CTV: PII Tools Will Revolutionize How You Store Sensitive Data. Try the FREE Demo Now!