Effortlessly locate every piece of credit card data and streamline your PCI DSS compliance with PII Tools. Perform in-house audits, remediate at-risk data, and avoid potential fines. This is how.

Intro to PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS, for short) is an information security standard organized by major credit card companies (Visa, Mastercard, etc.), aimed at forcing businesses to only process, store, and transmit credit card data in a secure environment.

If your business accepts credit and debit cards in any way, then the PCI DSS applies to you. It’s your job to locate the relevant data and ensure its safety, all the way from payment to transit to storage. Otherwise, you could face penalties that can reach as much as $100,000 per month for extended non-compliance.

(For more information about the PCI DSS, read Understanding PCI DSS v4.0.)

Scan for PCI DSS Data with PII Tools

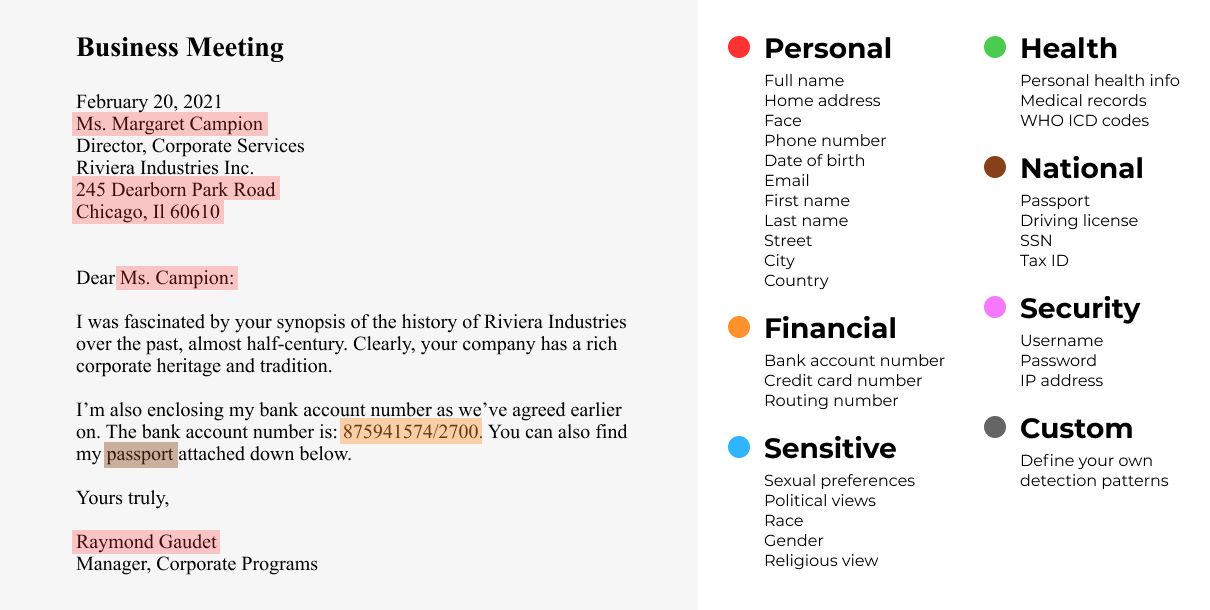

PII Tools is a sensitive data discovery software that allows you to discover, analyze, and remediate PCI DSS data and more. Think of it as a PII Scanner for comprehensive in-house audits you can perform at any time.

With thorough credit card data discovery, you can use PII Tools to perform scans of your local and cloud storages, emails, databases, archived and password-protected files, images, signatures, and more (see the full list). This PII detector even comes with built-in OCR to analyze scanned or rotated documents.

Once the scan is complete, you’ll receive a drop-down report to the precise PCI location of every piece of sensitive PCI within your environment. This then leaves you with a myriad of remediation options, such as restricting access to certain locations, files, or folders for your team on a need-to-know basis.

PCI DSS Data Risk Classification

It’s safe to say your business has more stored terabytes of data than you’d care to think about. Fortunately, PII Tools provides risk classification for all sensitive PCI DSS data discovered. This data is then sorted by its severity, content, or context (depending on your specific settings).

This automatic risk classification feature enables you to address the most urgent instances of at-risk credit card data first, as they appear at the top of the list, highlighted in red and orange as CRITICAL and HIGH, respectively.

3 Unique Features for PCI DSS Compliance

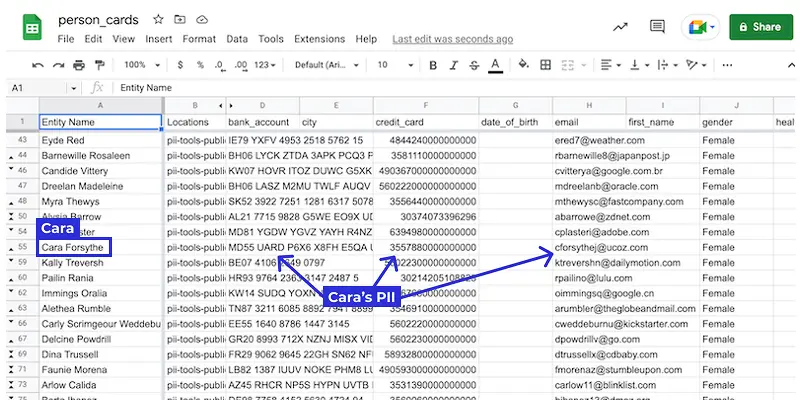

Person Cards®

PII Tools automatically links up all of the PCI-related data that its AI detectors found on each individual, such as their name, email, DoB, and credit card, stored anywhere in your environment.

This information is then rolled up into a Person Card®, which can then be exported into a spreadsheet for easier import into Relativity and other eDiscovery platforms.

AI Data Protector

If your company uses third-party AI models or tools, then you’ll appreciate the AI Data Protector. This unique feature secures sensitive data BEFORE feeding it into AI.

Enjoy the best of both worlds by still benefiting from helpful and time-saving AI tools while still keeping all PCI DSS data safe. Whether you’re preparing data for cloud storage, AI model training, or integration with AI tools, the AI Data Protector will ensure it’s clean and secure.

Sensitive Data Remediation

After you’ve used this PII scanner to complete a scan and review the most time-sensitive instances of at-risk PCI DSS data, PII Tools then affords you multiple remediation options.

Depending on its specific context and location, you can choose to redact or erase each instance of exposed credit and debit card data individually or in bulk. You can also move data to a more secure location, like a folder with restricted access, as well as quarantine or encrypt it. The choice is yours.

PCI DSS Compliance with PII Tools

PII Tools helps organizations achieve PCI DSS compliance by effortlessly locating every piece of credit card data, no matter where it’s stored. The result: An overall simplified process and secure data.

Avoid potential fines and penalties while also protecting both your company’s reputation and its clients’ sensitive credit card information. All through a user-friendly and automated dashboard that turns any employee into a data protector.

Automate & Streamline Your PCI DSS Compliance with PII Tools!