Today’s businesses are expected to adhere to many standards and regulations, everything from the notorious GDPR, to the more locally applicable LGPD. Luckily, many of the big-name data protection regulations share a similar base structure. But what about the PCI Standard? What sets it apart from the pack?

What Is the PCI?

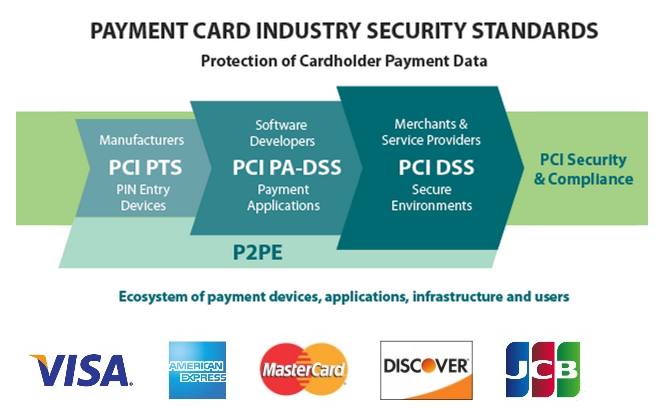

Before we get too far, we’ll need to answer the question: What exactly is the PCI? Well, for starters, it’s important to know the standard’s full acronym is actually “PCI DSS”—The Payment Card Industry Data Security Standard. However, to save time, simply “PCI” is commonly used.

By way of a quick definition, the PCI is an information security standard for organizations handling branded credit cards from the major credit card companies (large companies like Visa and Mastercard, as well as regional cards like Carte Bleue, JCB, etc.). Dating all the way back to December 2004, the PCI strives to ensure all companies that process, store, or transmit credit card information maintain a secure environment, thus improving the account security throughout the transaction process (to take a deep-dive on how to specifically become PCI compliant, the standard’s official website spells them all out for you).

Source: InfoAssure

Something a Bit Different

For business owners, or anyone involved in IT or data protection, having an isolated set of rules for processing and protecting credit card information doesn’t seem too far separated from other legal regulations. For companies working both locally and internationally, the GDPR, HIPAA, CCPA, etc. are practically household names.

There are, however, two large differences that set the PCI apart from its not-so-distant cousins. The first major difference is that the PCI isn’t actually a legal regulation at all. Believe it or not, the PCI was created by an independent body of Visa, Mastercard, American Express, Discovery and JCB. They are also the ones that administer and manage the PCI. In fact, they even have a special council whose job it is to do just that (the PCI Security Standards Council).

Alright, that sounds great. No legal regulation translates to no legal implications for breaking this standard, right? You may be surprised to know the PCI’s bite has more teeth than you might think—and that leads us to the second major difference.

Financial Restitution and Reputation

Now, the PCI Security Standards Council itself may not issue any fines, that doesn’t mean you’re getting off scot-free. For the PCI, it’s actually the payment providers themselves that issue fines. In addition, the banks that back these providers can impose other penalties, such as increasing transaction fees or even choosing to terminate your relationship altogether. And that’s not to mention the other possible financial hurdles: lawsuits, insurance claims, canceled accounts, etc.

Most importantly, however, your reputation as a company stands to take the hardest hit. If your insufficient card security results in account data breaches, you could suffer catastrophic loss of sales, relationships, and, most importantly, community standing. What sort of customers are going to do business again with a company that leaked their credit card information?

Becoming PCI compliant

With these potential dangers of PCI non-compliance in mind, it’s important to find a solution as soon as possible. The most effective way to adhere to the PCI while also remaining up-to-date on all the other regulations we mentioned above, is implementing PII Tools.

PII Tools is a personal and sensitive data discovery tool that provides the easiest solution to data audits and regulatory compliance. When used by your professional QSA (Qualified Security Assessor) or DPO (Data Protection Officer), PII Tools runs a scan of all your company storages, emails, databases, and the cloud, telling you if you have any PCI non-compliant data hiding away in some long-forgotten folder or SQL table.

Once this problematic data has been located, you can then use PII Tools to report, delete, or quarantine this information, thus remediating the situation. But should you still suffer a data leak or breach of any kind, your QSA or DPO can quickly identify whose data was breached, generate a detailed report, and recommend actions to prevent data breaches in the future.

The PII Tools Solution

As discussed above, PCI differs from the other noteworthy regulations in that it isn’t regulated by law, but rather by the card payment providers themselves, and that makes the PCI specific in its own way. In part, these differences, as well as a company’s need to work directly with the payment providers, remaining PCI compliant presents a challenge.

PII Tools, available as both self-hosted (local) and fully managed (cloud) software, was built with this challenge in mind. Not only will it help you with the PCI, but most of the other standards and regulations. And, in case of an emergency, you’re going to want PII Tools to help remediate the situation. Protect your company and client data today with PII Tools.

It’s Never Too Late to Become PCI Compliant! Take Our FREE DEMO and Get the Ball Rolling Today!