Credit Card Data Discovery for PCI DSS

Effortlessly locate every piece of credit card data and streamline your PCI DSS compliance with PII Tools. Simplify your process and ensure the data is secure.

Our Customers Say…

Mark Cassetta

SVP Strategy

“Our survey found that 22% of the time, humans failed to identify personal data in documents, while PII Tools succeeded in all scenarios. By integrating with PII Tools, Titus was able to significantly reduce the compliance risk for our customers.”

Shane Reid

Shane Reid, Group Director, CEO – North America

"Partnering with PII Tools transformed our data discovery processes, significantly improving accuracy and efficiency, and resulting in substantial ROI for Umlaut Solutions and its customers."

Sean Poulter

DBA Specialist

“Your support is fantastic. I love that you fix any issue in a couple of days. It shows me that you have the drive to constantly improve the solution, unlike many other companies.”

Where?

PCI-DSS is an IT security standard applicable to any company handling payment card data, regardless of its size or number of transactions processed.

Why?

Because companies such as Visa and MasterCard impose fines on non-compliant businesses which may even result in a denial of service. And, of course, there’s the potential damage to your reputation. Good luck explaining to your clients why you can’t accept their Visa.

What?

PCI-DSS compliance defines 12 critical requirements that are designed to protect every cardholder’s data. These include steps such as maintaining a secure IT environment and restricting access to a cardholder’s data.

How PII Tools Helps with PCI DSS

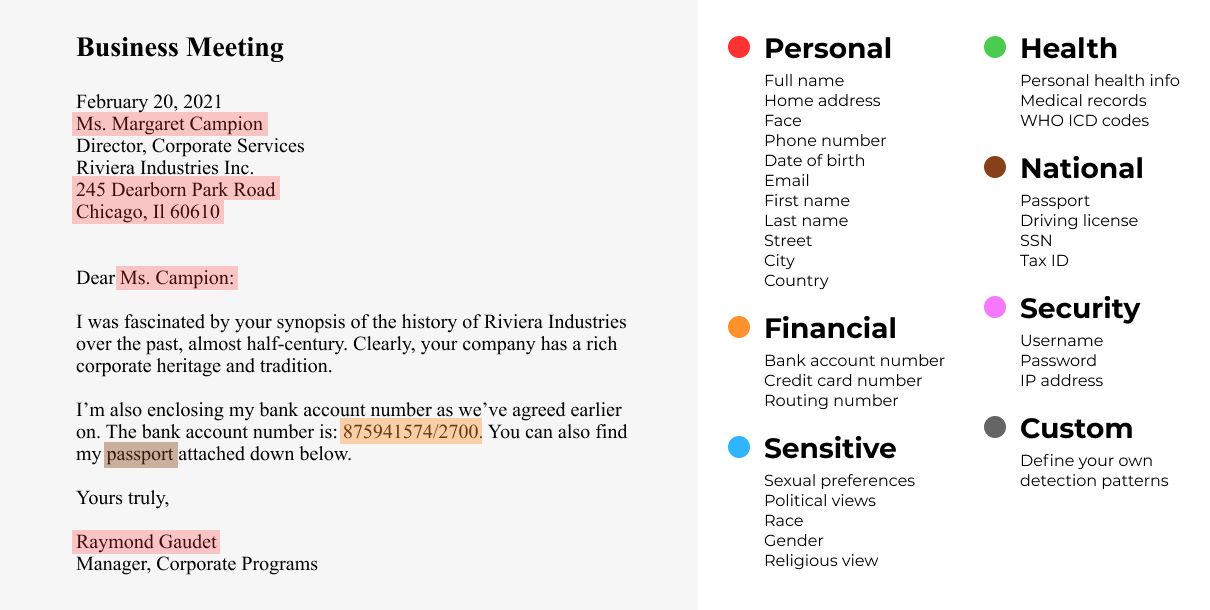

Thorough Credit Card Discovery

Find all sensitive PCI data in your environment. Scan local and cloud storages, emails, databases, archived and password-protected files, images, signatures, and more (see the complete list). Rely on built-in OCR to analyze scanned or rotated documents.

Precise PCI Location

With our card data discovery tool, you know the exact location of all the sensitive PCI in your storages. This enables you to restrict access to certain locations, files, or folders for your team on a need-to-know basis.

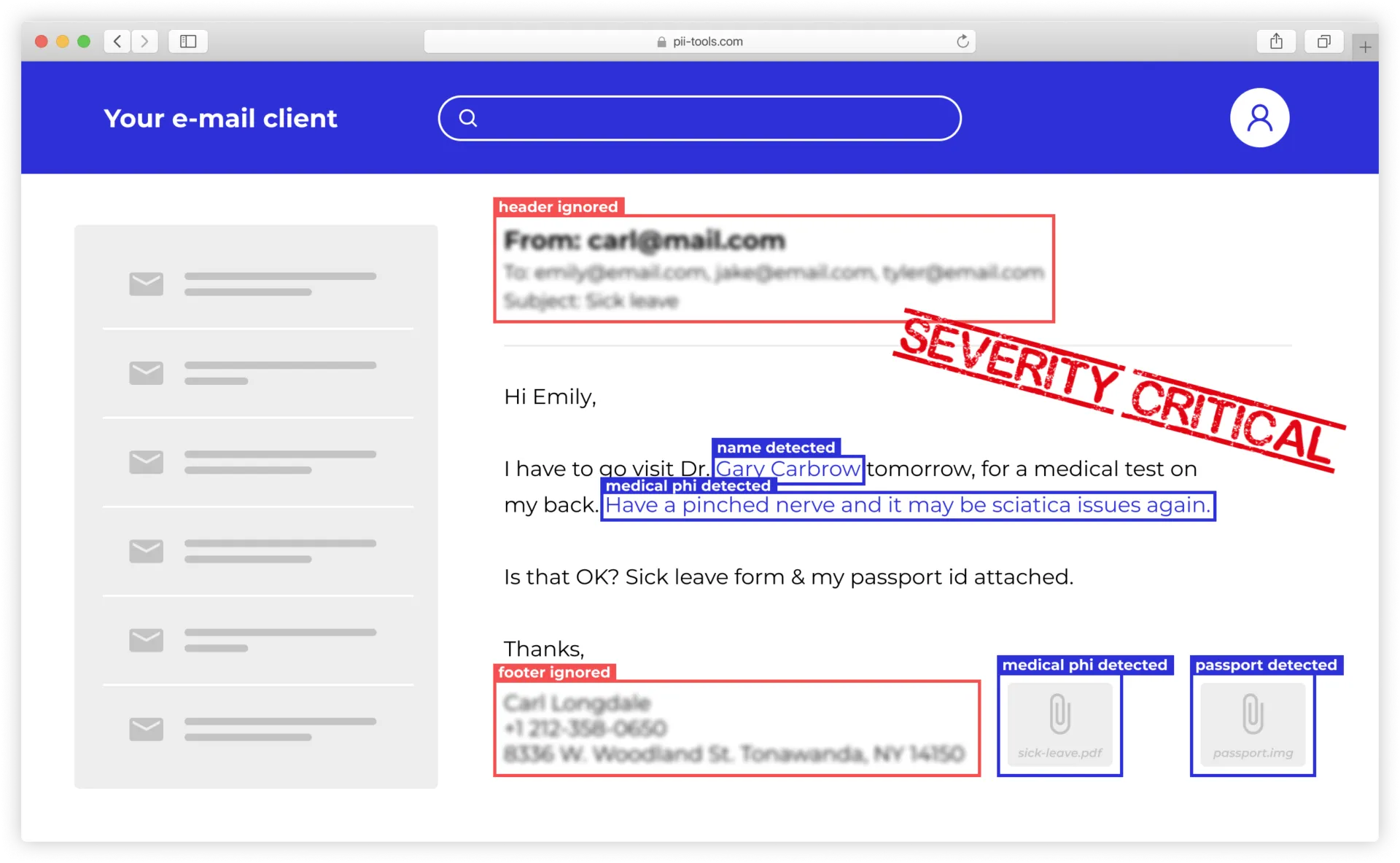

Risk Classification

Analyze and sort PCI data based on its severity, content, or context. PII Tools performs an automatic risk classification of every scanned file. This helps you to evaluate PCI data in context and improves your review experience.

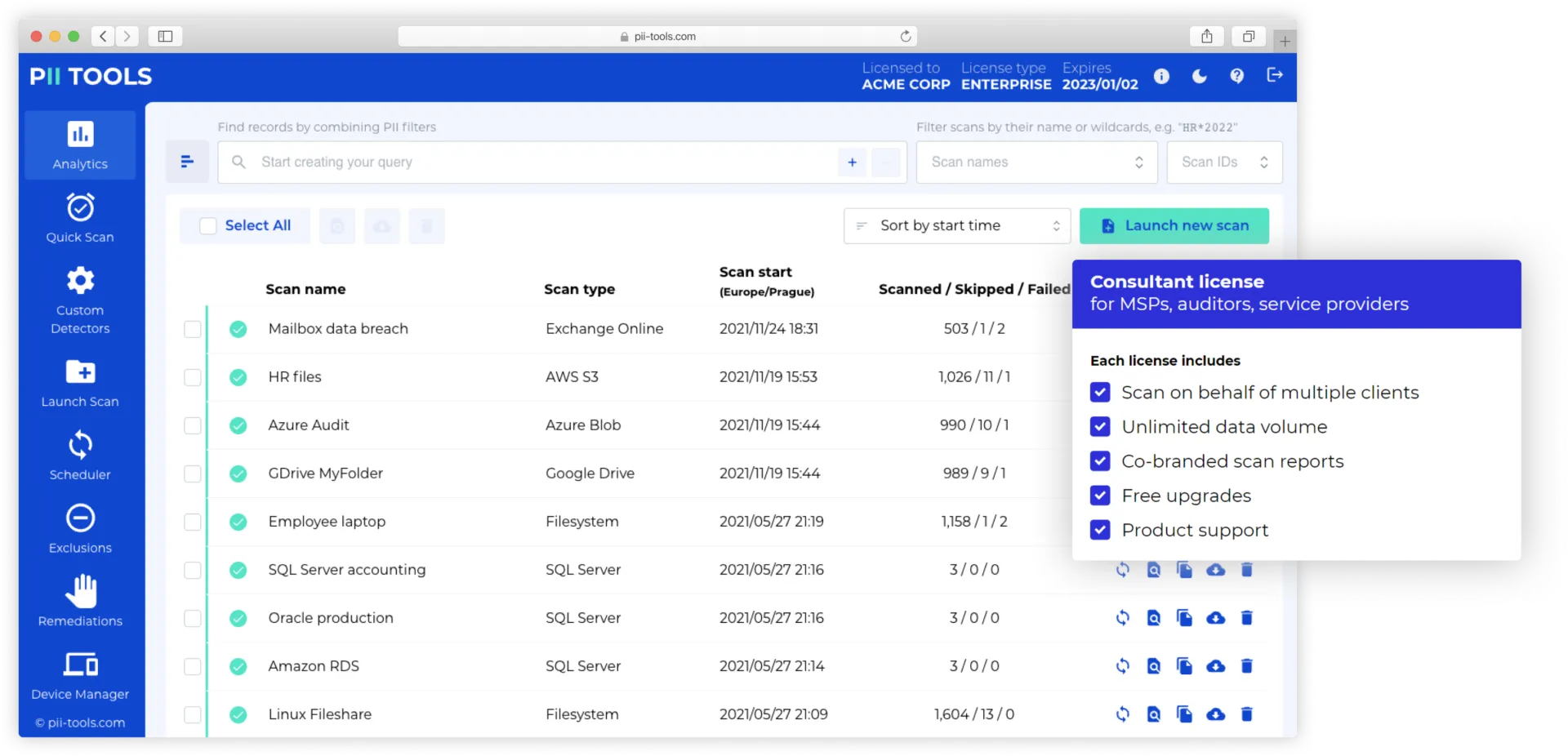

QSA Floating License

Our Floating Consultant License is tailor-made for every Qualified Security Assessor. It gives you the freedom to scan all your clients under one license, unlimited data volume, and many more features that every auditor needs.

Regular Email Scanning

The more employees and clients you have, the more mailboxes and digital communication is required. PII Tools can be set up to regularly scan each email in every mailbox for payment card information to ensure your employees don’t disclose any sensitive data.

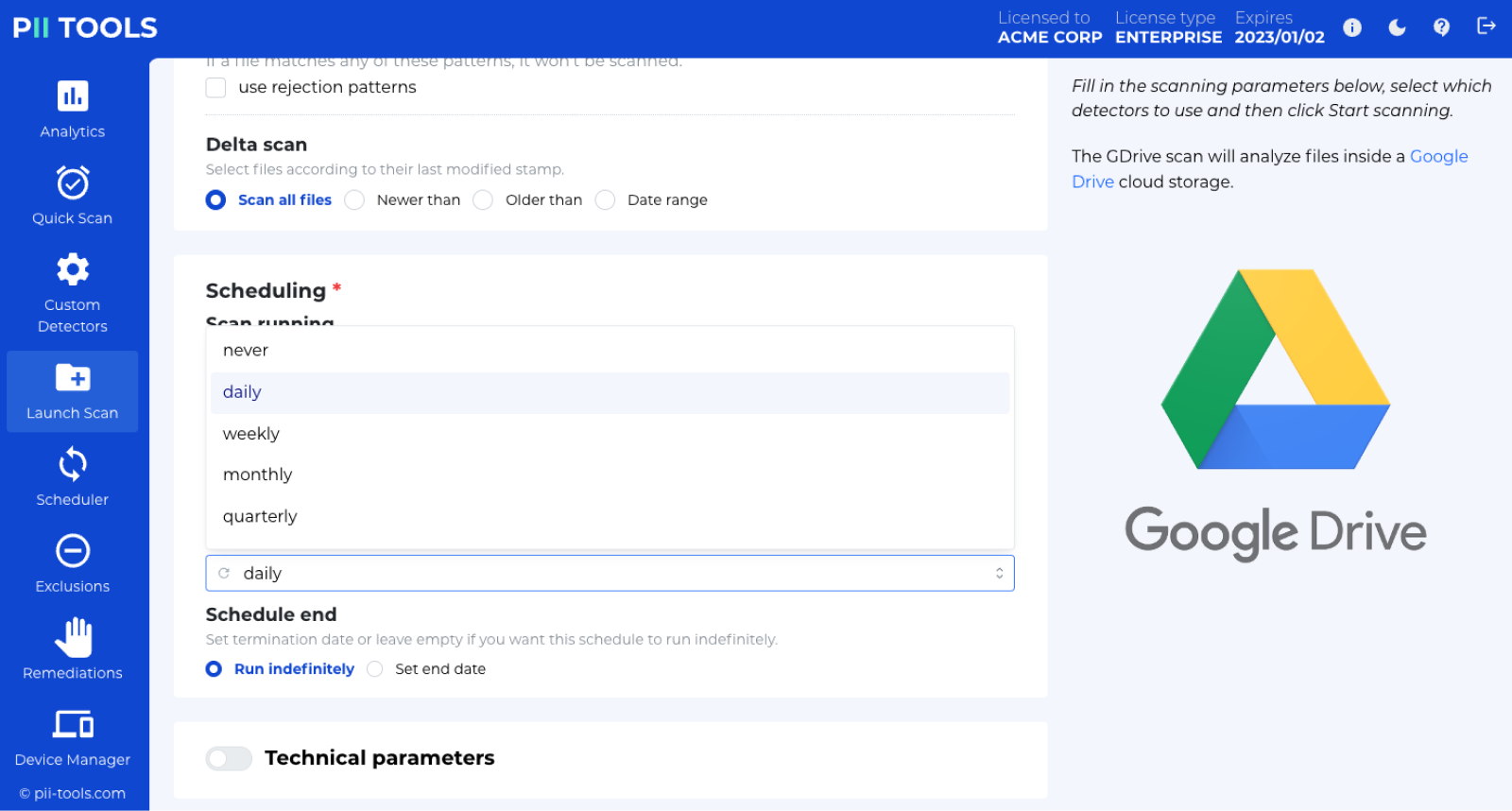

Continuous PCI Compliance

Set up scheduled, automatic scans of your environment and confirm no PCI data lives outside the designated locations. Plan automatic daily, weekly, or monthly recurring scans, and be ready for any PCI DSS audit.

Take Control of Your Personal and Sensitive Data Today!

Top 3 Reasons Clients Schedule a Demo with Us:

Avoid or solve data breaches

Comply with PCI DSS, GDPR, HIPAA, and other legislation

Prepare for an audit